Good question. Certainly, not everyone has, but spiraling levels of consumer debt have risen to record levels, indicating that Canadians are spending more money that they don’t have at an alarming rate.

Statistics Canada has released figures for the third quarter of 2014 indicating that Canadian household total credit-market debt, which consists of mortgages, consumer credit (mostly credit cards) and non-mortgage loans rose to 162.6 percent of disposable income. The Bank of Canada has stated that “high consumer debt loads and imbalances in the housing market” are a concern.

In short, people are using credit more today than ever before.

Two generations ago, very few people used credit. Society was based on a “cash on the barrelhead” philosophy that encouraged living within one’s means. This standpoint has been slowly eroded by rising home ownership costs (it is virtually impossible to purchase a home without a mortgage, and the length of time that the average family spends paying for their home gets steadily longer), the availability of consumer credit, and the replacement of “hard” currency with cheques, credit cards, and digital wallets.

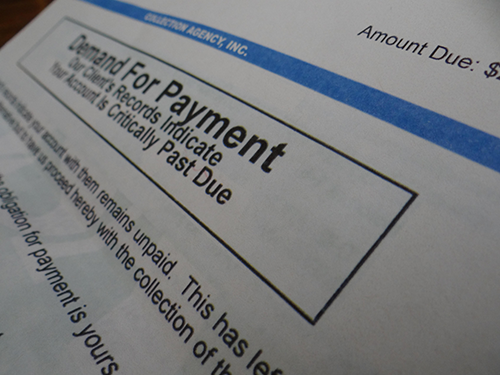

It’s easier to access credit today than ever before, and advertising inundates us with constant messages promoting consumption of high-value items, usually on payments. It’s no wonder that people wind up in trouble with credit cards, loans, and lines of credit.

Creditaid exists to help people who have used credit improperly, or have been faced with unforeseen circumstances, and are having trouble dealing with their debt. We offer a free initial credit counselling review with professionals who can advise you on how to best manage and repay your debts. We’ll work with you in a judgment-free manner to develop solutions for your specific situation. We have a number of tools available to help you deal with your creditors, including debt consolidation and debt management solutions. If you’re feeling the pressure of collections, call Creditaid for help today.