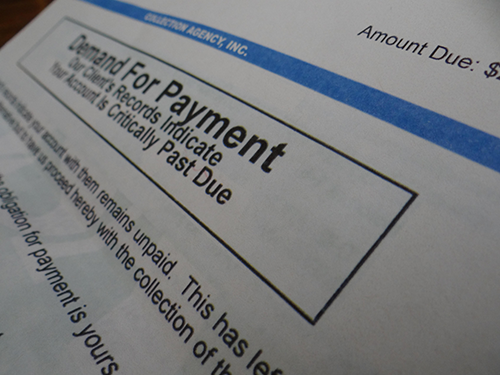

We all know that we need to be careful with credit – because it’s easy to borrow money, and wind up owing as much, or more than we can pay. We all know what it feels like when there’s “too much month left at the end of the money”.

And there’s this vague fear of a negative impact on our credit history that can affect us in the future. The more we know about credit reporting, the more we can work to improve the way potential lenders see us, and then we can leverage a good report to get favourable terms when we borrow money.

What is a Credit Score?

In Canada, a credit score is assigned by one of the two large credit reporting agencies – Equifax or TransUnion. The score is a number between 300 and 900 (900 being perfect) that represents  the aggregate of all of the information that the bureau has on file about us. Most interactions that you have with lenders, either positive (payments made on time) or negative (late payments, collections, bankruptcy) will affect our score. Anyone who has ever accessed any form of credit has a file with the credit bureaus. Potential lenders use your credit score, with your permission, to determine whether or not you qualify for credit, and sometimes they use it to set the terms of borrowing (interest rates, etc.).

the aggregate of all of the information that the bureau has on file about us. Most interactions that you have with lenders, either positive (payments made on time) or negative (late payments, collections, bankruptcy) will affect our score. Anyone who has ever accessed any form of credit has a file with the credit bureaus. Potential lenders use your credit score, with your permission, to determine whether or not you qualify for credit, and sometimes they use it to set the terms of borrowing (interest rates, etc.).

Who Can Access My Credit Report?

Any lender can provide information about your loan, payments, etc. to the credit bureaus. You give them permission to do so in the agreement you sign when you begin to access credit with them. Any potential lender with your permission (usually in the application) can access your report and score. You can (and should) access your own credit report with both bureaus. Make sure that all of the information that they have on file is accurate.

By knowing your own credit score, you can demonstrate to potential lenders that you are a responsible borrower. You may be able to negotiate more favourable terms as a result.

If you’ve got questions about credit, or have found yourself in some trouble, contact Creditaid anytime online or by telephone at (204) 987-6890 or (877) 900-2659. We can help you take those important first steps toward a debt free life.